Statement invoice

Statement invoice

Bank reconciliation in accounting refers to the process of comparing the bank statement transactions with the company's internal records to ensure consistency and accuracy of financial data. It involves matching the transactions recorded in the company's books with the transactions reported by the bank. Accountants compare items such as deposits, withdrawals, checks issued, and fees, and reconcile any differences or discrepancies between the bank statement and the company's records. Bank reconciliation helps identify errors, missing transactions, or timing differences, ensuring that the company's financial records are in alignment with the actual bank account activity. It is an essential step in maintaining accurate financial statements and monitoring cash flow.

To View Statement Invoice, Go to Account >> Transaction >> Statement Invoice

A statement provides details for an entire period instead of a single instance. It itemizes all transactions whether paid or unpaid. They usually are arranged as lists containing providers, amounts and dates.

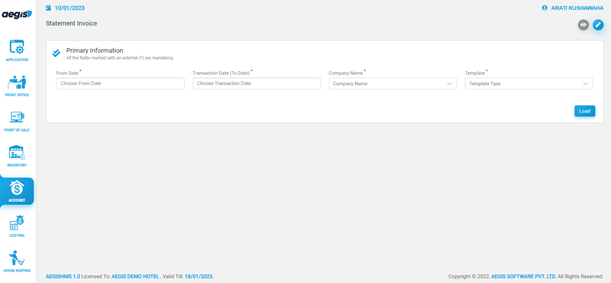

When you click on statement invoice you will be redirected to page where you can view list of invoices added if any. On upright corner there is an icon of ‘PENCIL’ which help to create or update any information.

After clicking on pencil icon, page shown below will appear where primary information can be added and saved to get the result

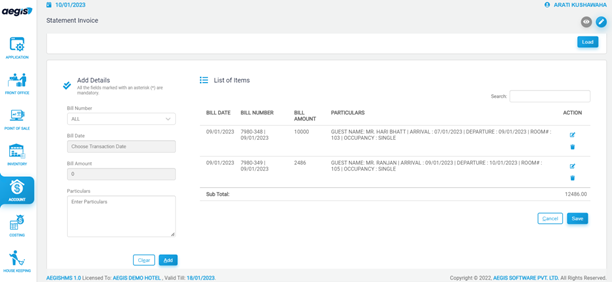

After adding the details we will get it on the list of item section as shown below which can be saved by clicking on SAVE or cntrl+S. After saving it can be viewed on main screen of statement invoice section.

No Comments