New Page

Aegis Software - HRM (Payroll) Module User Manual

🔧 1. Payroll Module Setup (Initial Setup)

1.1 Create Receivable Profile

-

Path:

Application >> Receivable Profile -

Enter staff receivable details here.

-

Ensure staff is created under proper staff classification.

-

✅ This setup is crucial for posting salary to accounting.

1.2 HRM Staff Profile Setup

-

Path:

HRM >> Staff Profile Setup -

Configure payroll and HR details.

-

Add staff's email address to enable auto-email of salary slips.

-

Include bank account details to generate a salary payment letter to the bank.

1.3 Payroll Head (Addition/Deduction Particular Heads) Setup

-

Path:

HRM >> Payroll Head -

Configure different salary components:

-

Title: Name of the head (e.g., Bonus, Basic Salary, Incentive)

-

Short Name: Abbreviation for the title

-

Apply Working Days: Select "Yes" if the head is affected by attendance (e.g., Basic Salary), else "No"

-

Order #: Determines the order of appearance on the payslip

-

Active: Mark active/inactive based on current use

-

Taxable:

-

Addition: Mark "Yes" if this head contributes to taxable income

-

Deduction: Mark "Yes" if it decreases taxable income (e.g., SSF, PF = Yes; Advance = No)

-

-

Taxable Head Comparison Table

| Payroll Head | Type | Taxable |

|---|---|---|

| Basic Salary | Addition | Yes |

| SSF Deduction | Deduction | Yes |

| Advance Salary Deduction | Deduction | No |

1.4 Payslip Structure Setup

-

Path:

HRM >> Payslip Structure -

Select staff ➝ Add required addition/deduction values ➝ Save

-

If applicable, choose Remote Area (A/B/C) to comply with government tax rules

✅ Setup is now complete. You are ready to create and post payslips.

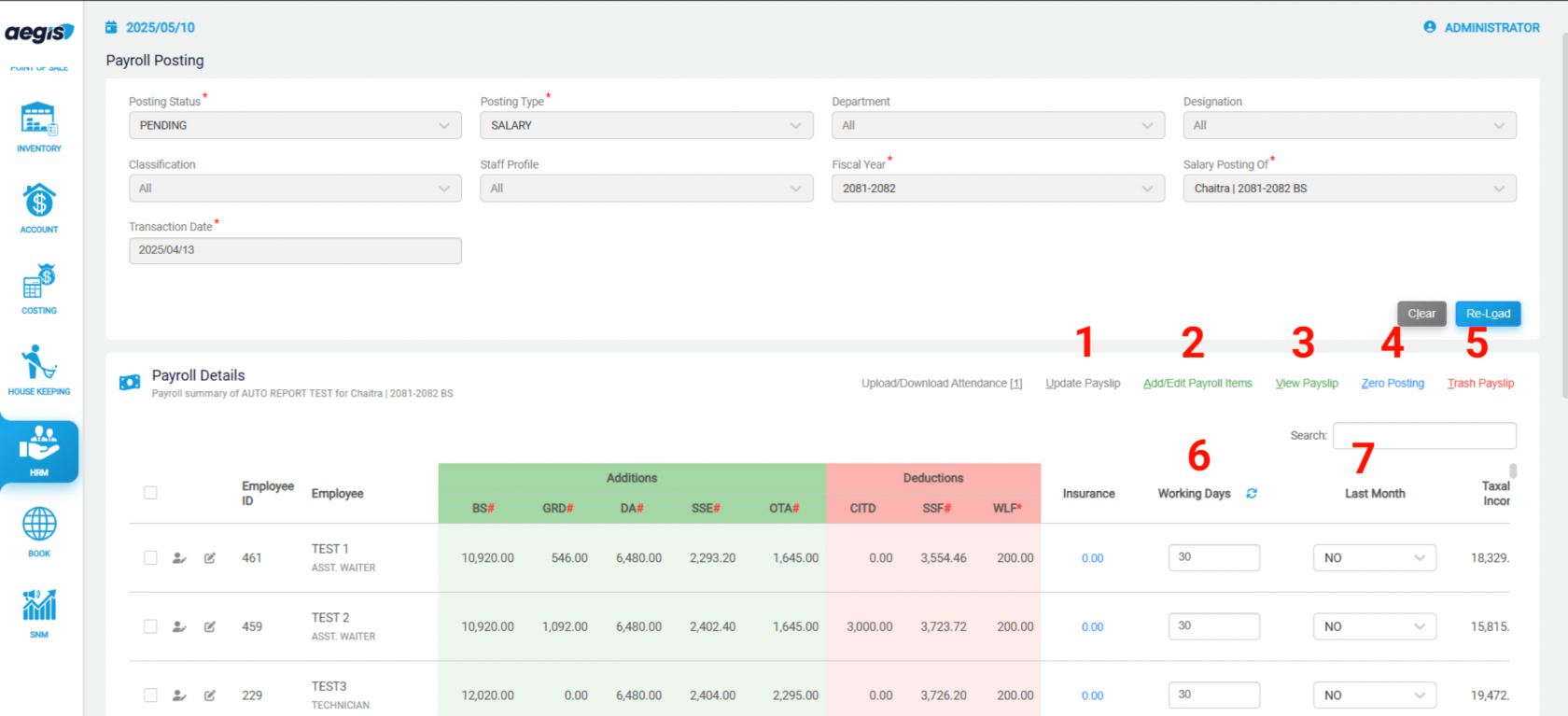

🔁 2. Transaction – Posting Salaries

Path: HRM >> Payroll Posting

Steps:

-

Select Posting Status: Pending, Posted, or Draft

-

Select Posting Type: Salary or Wage

-

Optionally, filter by Department, Cost Center, or Staff Classification

-

Choose Staff (multi/single/all)

-

Select Fiscal Year and Salary Post Month

-

Transaction Date: Defaults to month's end, but can be customized

1 Update Payslip

-

Update payslip structure without navigating to Payslip Structure setup.

2 Add/Edit Payroll Items

-

Add special one-time additions or deductions (e.g., Advance Salary).

-

Select staff ➝ Click Add/Edit ➝ Choose Head ➝ Enter Value.

3 View Payslip

-

Preview payslip before posting.

4 Zero Posting

- if someone joined mid of fiscal year. that case we have to post not working month to prevent TDS calculation for no work month.

5 Trash Payslip

-

Deletes draft or posted payslip.

-

⚠️ You can only trash posted payslips if voucher is not generated.

-

Trashed payslips move to Draft.

6 Working Days

- Enter here staff's attendent days.

7 Last Month = Yes

-

When selected, system treats the salary as final post for the fiscal year.

-

If a staff leaves early, TDS adjustments are auto-handled.

➤ Save as Draft

-

Use when you want to prepare payroll but post it later.

-

To post saved drafts, select status = Draft ➝ Load ➝ Post.

➤ Payroll Details

-

See a detailed breakdown of current payroll post.

➤ Download

-

Download selected staff payslips in Excel.

➤ Summary

-

View total tax, salary, deductions for reporting.

📐 3. Automatic Tax Calculation Logic

Tax is auto-calculated based on:

| Setup Area | Fields Considered |

|---|---|

| Staff Profile | Gender, Marital Status, Disability |

| Payroll Head | Taxable (Yes/No) |

| Payslip Structure | Remote Area selection |

| Payroll Posting | Working days, custom adjustments |

| Other | SSF, PF contributions |

📊 4. Reports Comparison Table

| Report Name | Path | Description |

|---|---|---|

| Staff Payroll History Report | HRM >> Staff Payroll History | Displays all posted salary data. Useful for checking salary records of each staff. Includes two views: Detail View (great for Excel export and manual reporting) and Summary View (grouped by Department, Staff, Month, etc.). |

| Payslip Structure | HRM >> Payslip Structure | Shows the salary details configured for each staff before actual posting. Includes all heads such as SSF, PF, and insurance. Also useful to verify upcoming increments (filter by Type = Upcoming). |

| Bank Statement | HRM >> Bank Statement | Prepares printable bank letters for salary disbursement. Filter staff by Department, Cost Center, Designation, and Month. Output can be viewed or directly printed as an official letter. |

| Payroll Transaction Report | HRM >> Payroll Transaction Report | Displays posted payroll data filtered by selected payroll heads. Allows you to choose which heads to include in the report. Also includes summary totals and customizable column order. |

| Tax Report | HRM >> Tax Report | Displays TDS/tax information based on posted salary per staff. Useful for internal auditing or preparing tax statements. |

| Staff Profile Detail Report | HRM >> Staff Profile Detail Report | Shows detailed staff information including basic profile and payslip data. Filterable to include/exclude specific fields. Good for audits or master record verification. |

| Staff Attendance Report | HRM >> Staff Attendance Report | Like the profile detail report, but includes working day and attendance data. You can control which additions/deductions appear. Monthly attendance and posted salary can be reviewed here. |

| Payslip vs Posted Report | HRM >> Payslip vs Posted Report | Helps you compare the values set in Payslip Structure vs what was actually posted. Useful for catching mismatches or corrections required before final reports. |

🛠️ 5. Additional Tools

➤ Template Design

-

Path:

HRM >> Template Design -

Customize bank letter templates using keyboard tokens.

➤ Staff Classification Setup & Rights Control

-

Path:

-

HRM >> Staff Classification Setup -

HRM >> Staff Profile Setup -

HRM >> Userright

-

-

Classify staff for HR segmentation.

-

Use

Userrightto assign user-based access on transactions & reports.

🎉 Congratulations!

You now know how to:

-

Setup staff, payroll heads, and payslip structure

-

Post and manage payroll transactions

-

Handle tax configurations and end-of-employment TDS

-

Generate reports, letters, and export data