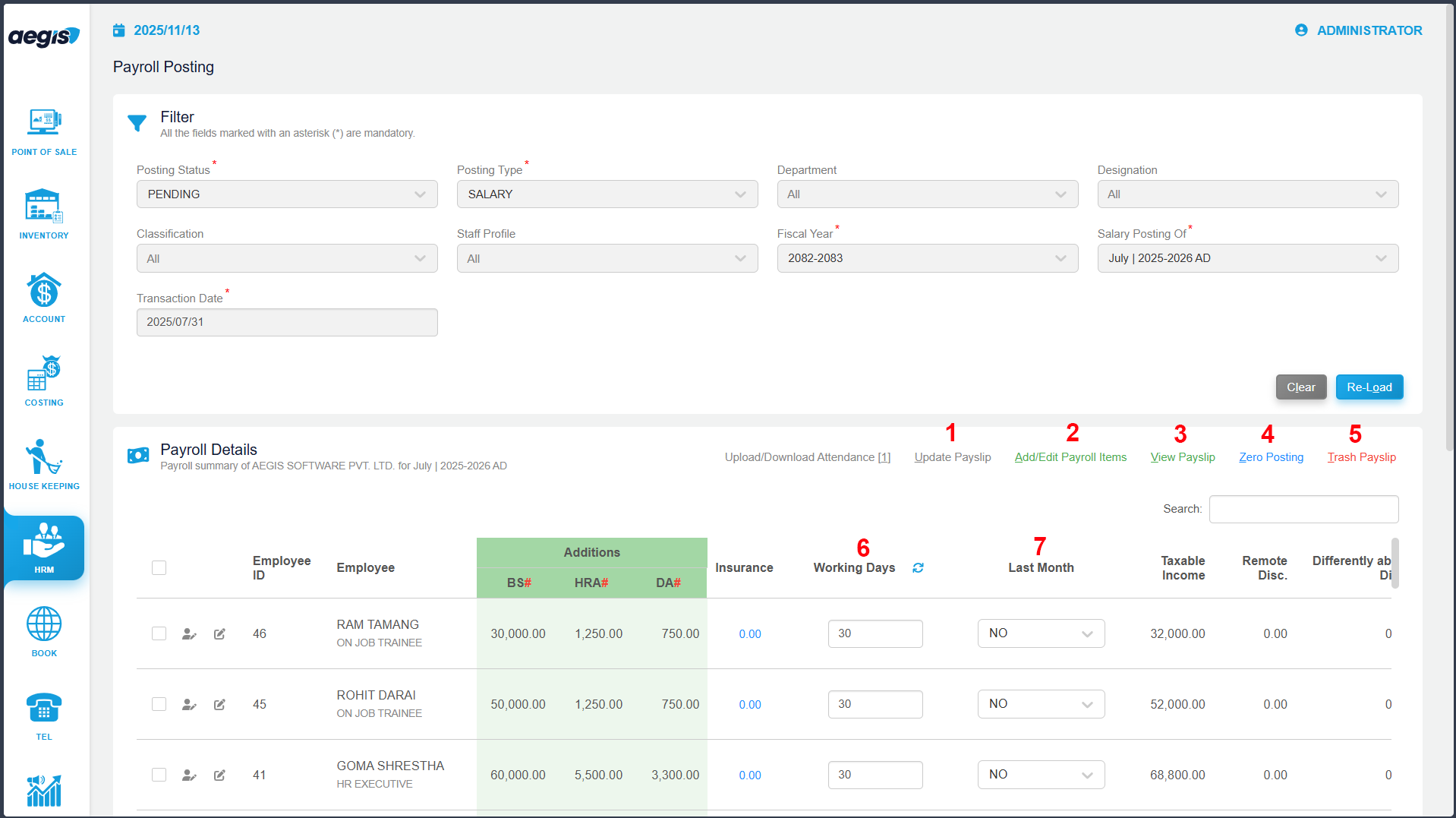

Payroll Posting

Payroll Posting (Transaction – Posting Salaries)

The Payroll Posting module in Aegis PMS allows administrators to process salaries for staff members. It provides a structured workflow to calculate payroll, adjust salary components, apply tax rules, and generate payslips.

Location:

HRM → Transaction → Payroll Posting

Access Payroll Posting

-

- Posting Status: Select Pending, Posted, or Draft

- Posting Type: Select Salary or Wage

- Optional filters: Department, Cost Center, Staff Classification

- Staff Selection: Choose Single, Multiple, or All Staff

- Fiscal Year & Salary Post Month: Select applicable fiscal period

- Transaction Date: Defaults to month-end but can be customized

Key Features

1. Update Payslip

Update a staff’s payslip structure without navigating to the Payslip Structure setup.

2. Add/Edit Payroll Items

Add special one-time additions or deductions (e.g., Advance Salary):

-

Select staff → Click Add/Edit

-

Choose the payroll head

-

Enter the value

3. View Payslip

Preview an individual payslip before posting to ensure correctness.

4. Zero Posting

For staff who join mid-fiscal year:

-

Post “zero” salary for non-working months to prevent incorrect TDS calculation.

5. Trash Payslip

Delete draft or posted payslips:

-

Posted payslips can only be trashed if the voucher is not generated

-

Trashed payslips move to Draft status

6. Working Days

Enter the staff’s attendance days for the month to calculate pro-rata salary.

7. Last Month = Yes

-

Marks the salary as the final post for the fiscal year

-

TDS adjustments are automatically handled for staff leaving mid-year

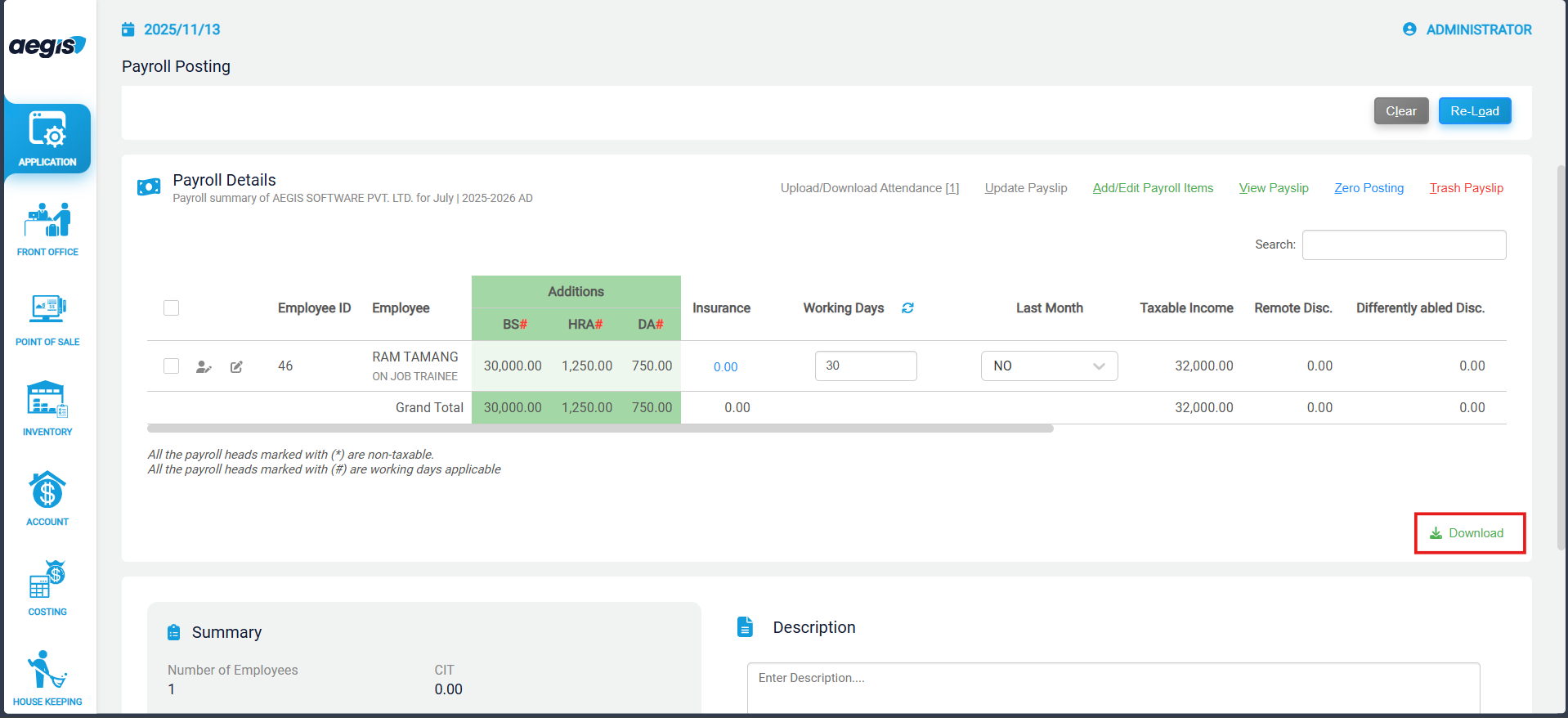

Draft & Posting Workflow

-

Save as Draft: Prepare payroll but post it later

-

To post a saved draft:

-

Set Posting Status = Draft

-

Load the draft

-

Click Post

-

Additional Options

-

Payroll Details: View detailed breakdown of the current payroll post

-

Download: Export selected staff payslips to Excel

-

Summary: View totals for Salary, Tax, and Deductions for reporting purposes

Automatic Tax Calculation Logic

Payroll tax is automatically calculated based on multiple inputs:

| Setup Area | Fields Considered |

|---|---|

| Staff Profile | Gender, Marital Status, Disability |

| Payroll Head | Taxable (Yes/No) |

| Payslip Structure | Remote Area selection |

| Payroll Posting | Working days, custom adjustments |

| Other | SSF, PF contributions |

Note: Correct setup in all areas is essential to ensure accurate tax computation.